It’s no secret that the City of Folsom is facing budget woes in its future that have many residents concerned about crucial needs, especially that of public safety. As of today, a group of concerned Folsom citizens have launched a formal campaign to address the city’s looming revenue crisis and keep more public funds in Folsom and have filed the initial documents to bring a proposed tax measure to the 2024 ballot.

Known as Residents Supporting Public Safety and Quality of Life Committee, the group’s mission and plans were announced in a press release late Tuesday evening. The newly formed citizen’s group is made up of more than a dozen community members and led by former city employees Bruce Cline and Robert Goss, co-chairs of the coalition.

The group cites that their actions are in response to warnings raised by the City Manager and the city’s Finance Department indicating city revenue is flattening as the growth of online shopping diverts more of Folsom’s sales tax revenue to the county and to other cities.

That dynamic, dubbed “the Amazon effect,” plays out against a backdrop of rapid inflation, unfunded mandates from state government, and other increasing costs,” according to the group’s press release. “The result is Folsom – which currently has the lowest sales tax rate in the county (tied only with Citrus Heights) has reached a point where expenses are outpacing revenue. The city is facing a structural deficit of millions of dollars – starting with a projected $1.1 million gap in the next year,” the press release explains.

Cline and Goss cite that the city’s options are either to further reduce services, raise revenues, or both. According to their press release, many Folsom residents, who expect a high level of service from their city, cutting essential services is not an option – the city already has 77 fewer employees and 9 fewer police officers today than it did in 2008. T

The topic has been previously discussed by members of city council who have not formally acted on approving a ballot measure. Back in October, council requested the topic be brought back before council in January of 2024 to review the proposed “language,” such a measure would include should they chose to move forward.

“Our city is facing a financial shortfall that will negatively impact our public safety, property values, and the quality of life we all enjoy,” said Cline, former City of Folsom Attorney. “Nearly 20 years of independent audits show our city has been using public funds responsibly. We don’t have a spending problem – we have a revenue problem. Sales tax through on-line sales mostly ends up in the County, not in Folsom, and we can fix that.”

The citizens group is proposing a 1-cent (1%) sales tax where all funds generated remain in Folsom, can only be used on specified public safety, traffic and quality of life needs, rather than for the city’s general fund. The initiative requires a Citizens Oversight Committee to monitor how funds are used. If passed, the proposal would put Folsom’s sales tax rate on par with neighboring cities at 8.75%.

Cline and Goss sat down with Folsom Times prior to Tuesday’s public accouncement and explained that as a “special” tax, the new revenue can only be used for identified purposes in Folsom, including public safety (fire protection and emergency medical response, reducing crime and addressing homelessness), improving traffic and repairing damaged streets, improving parks and trails, stormwater system improvements for flood protection, community enhancement projects, and economic development. Funds cannot be used to enhance pensions or retirement benefits for city employees.

Estimates from the city’s finance department suggest the proposal would raise $29 million annually, none of which could be taken by the state or county. Data from the finance department also shows that as much as 40% of Folsom’s sales tax is paid by out-of-town shoppers and visitors, who also benefit from Folsom’s public services.

“There are real consequences if we fail to take action – we cannot have a safe community with well maintained essential services if we don’t do something now” Cline says. “We limit our ability to address crime and homelessness or attract new business and jobs, our parks and playgrounds fall into increasing disrepair, and we must invest in our future to ensure Folsom remains the great place that we all enjoy. Strong property values also rely on having a safe community and a single penny goes a long way. We can’t afford to do nothing.”

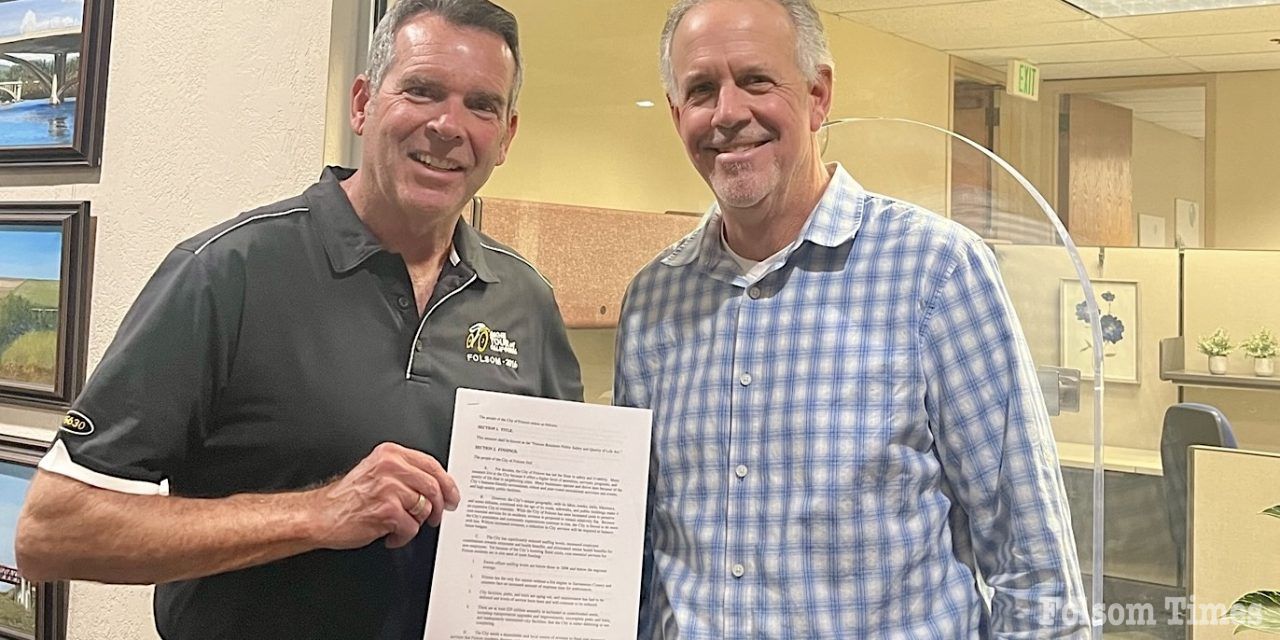

On Monday, Dec. 3, Cline and co-chair Robert Goss submitted the official notice and filings to the City of Folsom to begin the process of getting the initiative on the 2024 ballot. Once the public notices are officially published within Sacramento County this week, the group will then begin the process of collecting signatures over the next several months to put the proposal on the November 2024 ballot.

Goss and Cline met with Folsom Times after completing the group’s filings and prior to Tuesday’s public announcement. The two former Folsom staffers shared in detail, many of the key reasons and components they have launched the effort to place the measure on the 2024 ballot.

“A lot of people tend to think the city has the ability to make reductions in other areas, or basically cut the fat,” said Goss. “I can assure everyone, there is no funny business going on with the city’s finances. In most cases the fat has been cut and the city is faced with doing much more today with far less to work with.”

One of the more eye openings piece of information they illustrated was the reduction of General Fund employees to date while the need has continued to grow. In 2007 and 2008, the city had a general fund employee count of 460.88. In the 2023/24 fiscal year, that count is now at 373.05, showing a net reduction of 87.83 of full time employees over the 16-year period, according to data compiled by Goss and recently shared at the latest City of Folsom Parks and Recreation meeting.

Working off the estimated $29 million dollar number that a 1% city tax hike would produce annually, the group has detailed a strategy plan to determine how much of those funds would be allocated where for the needs of the city. The majority of the categories focus on public safety and quality of life and would be as follows:

Fire and Emergency Medical services $5.8M (20%)

Police services $5.8M (20%)

Street and traffic improvements, water quality $4.35M (15%)

Parks and Trails system improvement $4.35M (15%)

Community and economic development $4.35M (15%)

Major capital improvement projects $4.35M (15%)

One of the big topics that has come up when discussion of a tax increase has been on the table is what the cost would equate to for Folsom residents. According to the group’s data, Folsom residents that spend $5,000 on taxable goods a year would see an increase of $4.17 per month; those who spend $15,000 a year on taxable goods would see an increase of $12.50 and those who spend $25,000 a year on taxable goods would see $20.83 per month. These figures are on taxable goods, which excluded items such as groceries.

According to Goss, the majority of Folsom residents fall into the $15,000 category when it comes to spending on taxable goods in the city. He pointed out that 40% of sales tax generated in the city today comes from non-residents visiting or spending in the city.

“When you look at public safety, $12.50 per month per household isn’t a huge change, considering the risks involved if we don’t do something,” said Goss. “This would be a special tax that is not for general government expenses and can only be used for the specific categories with oversight to insure that.”

Ironically, the announcement of the citizen’s group to Folsom City Council fell on the same night in which one of the topics on the night’s agenda included direction from city staff for council to reject all recent bids that have been collected for city park landscape services after a to reevaluate just how many services they need following a significant rise in costs.

“That’s just one situation and there will be many more ahead,” said Cline. “When we are forced to reduce services, even on something like landscaping, it comes with other issues. Depending on what they choose to do without, we could see our playgrounds deteriorate, our trails and more.”

While parks would receive a 15% boost from the tax measure, the biggest focus remains on public safety first and foremost. Goss and Cline have compiled data that show within that 16-year reduction in FTE, Folsom is currently operating with nine fewer officers than it was in 2007, which is below the regional per capita average.

Another example they shared was the lack of a water tending fire engine at Folsom’s Fire Station #35 which services the Historic District. The truck won’t only come with a cost for the equipment, it will need at least nine firefights to staff it for all shifts.

These were just a handful of the items detailed in Goss’s recent presentation and summary. The several page presentation details the many issues the city of facing when it comes to future finances, comparisons to neighboring cities and visual explanations of the budget shortfalls they see ahead. The entire presentation can be viewed here.

So what are the next steps for the group? Now that their intent has been filed and will become public notice this week, the next task will be their goal of collecting 6,500 signatures from residents to insure the measure qualifies for placement on the ballot.

They are planning a number of events to connect with the community, including an upcoming signature event on Dec. 20 at Red Bus Brewery in Folsom, with details to be announced following the posting of the public notice. As of Tuesday night, their website is set to go live to reach the community with details and progress at www.folsomtakesaction.org.

This is a developing story that Folsom Times and All Town Media LLC will continue to follow and update.