A special sales tax measure will officially be on the ballot for Folsom voters to decide on, following Tuesday’s Folsom City Council meeting where council members took the next steps to put the option on the ballot for the upcoming election in November of this year.

Tuesday night, council members passed Resolution No. 11207 to formally place the citizen-led “Folsom Residents Public Safety and Quality of Life” measure on the November 2024 ballot to allow Folsom voters to decide on a special sales tax that would fund a number of designated needs across the city. The ballot item comes just as the City of Folsom faces future financial shortfalls and challenges in the years ahead, hindering needs ranging from public safety, community amenities and more as detailed in a Folsom Times article published on Wednesday May 30.

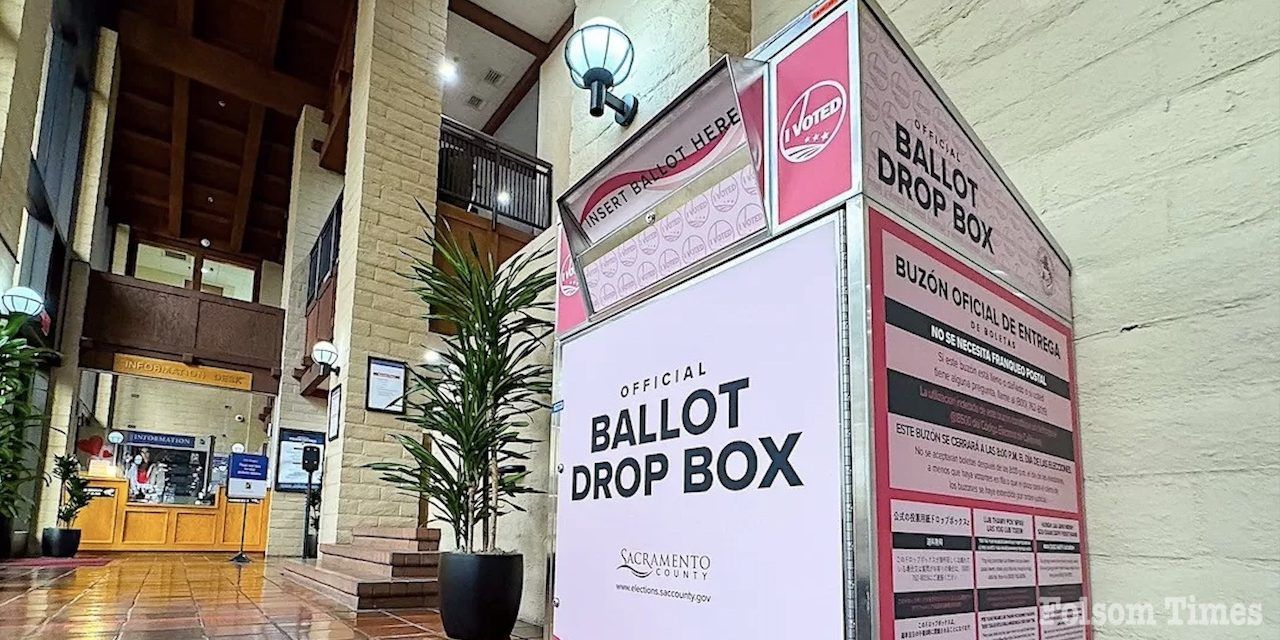

Earlier in May, the local citizen led group Folsom Takes Action officially received certification from Sacramento County Voter Registration and Elections officials that their proposed special 1% sales tax revenue measure had qualified for the November 2024 ballot. After the qualification, the measure went to city council for the final step to be penned onto the ballot.

“More than 8,200 community members expressed their support for this important special sales tax measure by signing our petition to put this measure before voters in November,” Bruce Cline, co-chair of Folsom Takes Action, the citizens’ group behind the measure said following the news of the qualification.

“We needed 5,071 valid signatures to qualify for the ballot and the high number of signatures is indicative of strong community support to assure we have the necessary resources for police, fire, parks, trails and essential services in Folsom.”

As a “special” tax, the new revenue can only be used for identified purposes in Folsom, including public safety (fire protection and emergency medical response, reducing crime and addressing homelessness), improving traffic and repairing damaged streets, improving parks and trails, stormwater system improvements for flood protection, community enhancement projects, and economic development. All funds raised by this measure would remain in Folsom, and spending with be monitored by a Citizens Oversight Committee with an annual, independent audit.

This citizen’s initiative is a response to warnings raised by the City Manager and the city’s Finance Department indicating city revenue is flattening and, despite more than a decade of efforts to cut costs, revenue is not keeping pace in manner to maintain basic City services.

“People have changed how they shop. That affects revenue for cities and Folsom is no exception,” said Robert Goss, co-chair of Folsom Takes Action. “With the revenue generated by this special sales tax measure, every cent generated would stay in Folsom.”

“As Folsom Firefighter’s Association representative we have sought funding for public safety and the revenue is simply not there,” said Dan Carson shortly after the qualification was determined. “We must invest in our community to keep it the safe and special place that residents know and love. Being born and raised and living in this city for 30 years, I am proud to be a member of the Folsom Fire Department, but I have seen the decline in the city’s ability to provide essential services across all departments. Since cuts during the recession, Station 35 has no Type 1 Fire Engine, a vital piece of fire suppression equipment for our Historic District – the only station in Sacramento County without this critical equipment. This measure gives residents an opportunity to support essential public safety and basic City services.”

According the group, estimates from the city’s finance department suggest the proposal would raise $29 million annually, none of which could be taken by the state or county., according the measure. Data from the finance department also shows that as much as 40% of Folsom’s sales tax is paid by out-of-town shoppers and visitors, who also benefit from Folsom’s public services.

If passed by voters in November, the special tax will be allocated for specific purposes in the following percentages:

20 percent to maintain and improve police services and additional staffing, and to provide equipment and facilities for our police force.

20 percent to maintain and improve fire, rescue and emergency medical services, and to provide equipment and facilities for our firefighters and paramedics

15 percent to maintain and renovate existing parks, frails, and other recreation facilities, including sports facilities used jointly with the Folsom- Cordova Unified School District and provide for funding to complete identified incomplete Parks and trails.

15 percent to improve traffic congestion and safety, street maintenance, storm system repair, and to maintain creek corridor and water quality.

15 percent for investments and projects to enhance quality of life and long-term economic viability for the city, such as those consistent a city adopted master plan.

15 percent for major improvements to City infrastructure or facilities, including transportation/traffic safety, stormwater systems, parks and recreation facilities, public safety facilities, parking facilities, libraries and large capital equipment.

According to Tuesday night’s staff report, the measure comes with the requirement of an annual audit and an active and dedicated Citizen’s Oversight Committee to ensure that funds generated by this measure are used consistently with the will of the voters and the needs of the City as a whole. This Committee will be charged with examining the funds received from this measure and recommending a spending plan for these funds to the Folsom City Council, examining how those funds are spent, and submitting a report to the residents of the City of Folsom and the City Council each year.

In the coming months, the Folsom Takes Action group will continue educating the community on the different aspects of the measure prior to the election. For more information about the measure can be found at www.folsomtakesaction.org.